How to Prepare for the End of your DACA Permit

At our law firm we frequently hear clients say, “Without DACA, should I sell my [insert asset here].” An expired DACA permit or the repeal of the DACA program and the threat of an uncertain future brings out these sorts of anxieties.

However, Bull City Lawyer wants every DACA recipient (current and expired) to understand that there are ways to protect one’s assets in the United States, regardless of the outcome of Dreamers Act negotiations in Washington D.C.

This can be done through the creation of a Limited Liability Company or LLC and the filing of an SS-4. While we would recommend this route regardless of the political climate, and regardless of immigration status, now might be the best time for DACA recipients to anticipate a life after DACA and to protect assets, and establish a company structure as if they were to become a foreign national.

How to Protect your Assets without a DACA Work Permit

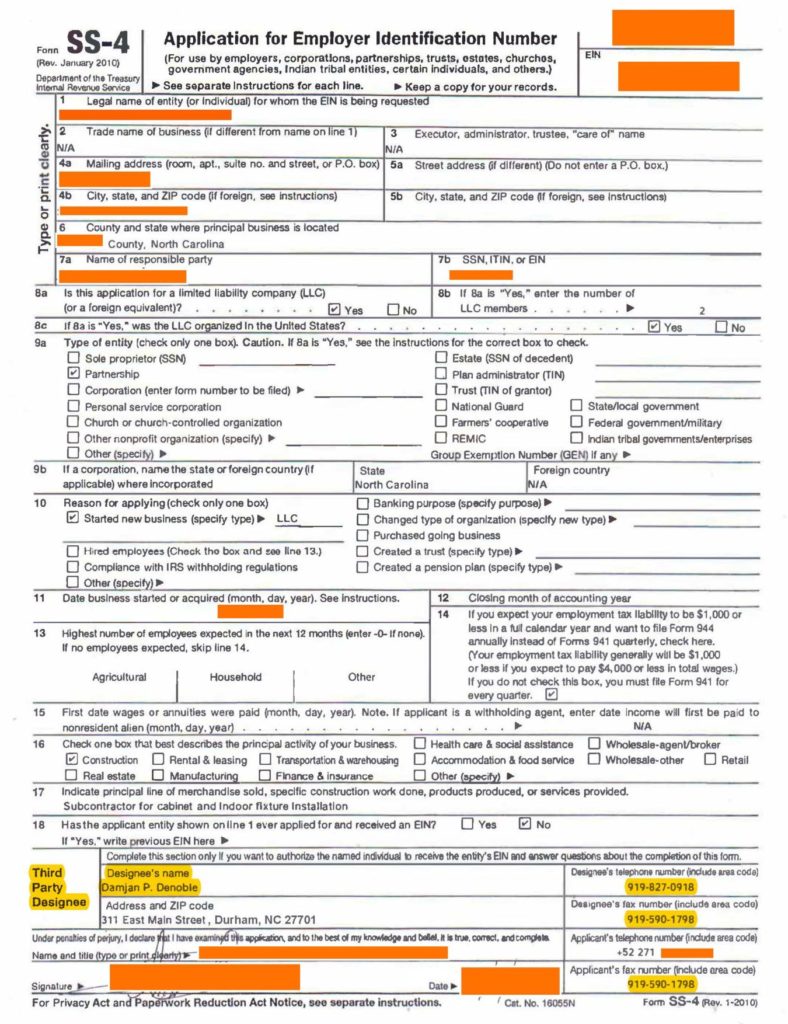

By establishing an LLC corporation and then completing an SS-4 (or application for Employer Identification Number (EIN)), DACA recipients can ensure that their hard earned assets are protected in the event that their DACA work permit expiress and they are unable to renew or administration repeals the DACA program.

An example of asset protection would be establishing your home as property of your LLC. This protects the house because an LLC can be owned remotely, meaning the LLC owner is not required to reside in the same state or country as the LLC’s origin. In the event of a removal action, an LLC owner could execute the sale of his/her home in the United States.

The same logic would apply to ownership of a motor vehicle or other valuable asset(s). While you might not be in the states physically due to having been removed, you could still exercise ownership rights of property that your LLC owns. This ensures that the house you may have made payments on for the last 10 years does not become property of government.

Company Ownership, Taxes, Bank Accounts as a Foreign National

The most important general takeaway is that no immigration status is require in order to establish a corporation, acquire an Employer tax identification number, or open a bank account in the United States. Indeed, it is in the United States’ interest to have as many people from around the world operating and running businesses inside the country as possible. As a result, companies can be owner by foreign nationals who have no immigraiton status in the U.S., the IRS will give foreign nationals tax ID’s for their companies so that those companies pay taxes in the country, and many banks will provide bank accounts for foreign-owned businesses.

The key step that you should think about when looking to hire a third party for assistance is the filing of the SS-4, which allows a registered business to get an Employer Identification Number for tax withholding. The form, pictured below, requires the foreign national to have a qualified “designee” as a sort of sponsor. This designee should be someone with a phone number, fax, place of headquarters, and the skill set to manage important papers.

You’ll notice that in the image above, if you look at the yellow highlighted portion, that Damjan P. Denoble, the founding attorney here at Bull City Lawyer, is named as the designee for an LLC formed in North Carolina. This was done for a foreign national client of our firm.

You Don’t Need DACA or a Work Permit to Succeed

Not only is the LLC and SS-4 path a means to protect your assets, this route can actually be a strategic business move as well and you should consider it regardless of what the Trump administration may or may not be doing to preserve or get rid of DACA.

Foreign nationals have always viewed owning their own company as the most secure way to earn an income in the United States. This is true for multiple reasons–the primary being that foreign nationals can establish LLCs regardless of citizenship. Additionally, in the event of removal, these businesses can continue to operate despite the physical absence of their owner(s).

An example of this would a foreign national without citizenship partners with a U.S. citizen to establish an LLC. In the event that the undocumented owner is removed from the United States/detained for whatever reason, the business can survive the removal and continue operating in the United States.

The LLC’s ownership structure would remain the same, and the parties business relationship would stay intact. In our opinion, it is the best time to utilize the training and experience you have gained through your DACA permit to establish your own business.

Final words

While this article is designed to alleviate the fears of DACA recipients who lose their work permit (or are in danger of doing so), this LLC/SS4/bank account strategy is on that can be useful to any/all foreign nationals. If you’d like to learn more about the process, please contact one of our attorneys at (919) 827-0918.

Leave a Reply